Acting in both a finance and marketing role at Mark's Auto Sales, I find that several times a month we are trying to structure a car deal with a customer that has a trade in that they have not yet paid off. Sometimes the customer has equity in this vehicle, and have a low pay off, such that their trade works to their advantage in purchasing their next vehicle.

On the other hand however, I see customers who are eager to get a new car, yet have negative equity in their vehicle. Because they owe more on their trade, than the vehicle is worth, the pay-off balance must be paid for in their next car purchase. Often times, these customers eager to trade in a car they are still paying on are looking for a lower payment. A lower payment may be possible if a customer has improved their credit such that they can qualify for a better interest rate with a bank. A lower payment may also be possible if the customer is trading in their vehicle for one at a lower price than their first loan. Often times however, customers are eager to trade in this vehicle for something newer, with lower mileage, and do not have any additional money down. As the banks are selective in approving auto loans, with a limited amount of credit to extend, these customers often find it difficult to make their purchase.

Therefore, I would like to extend some advice to the customer looking to trade in their vehicle. First of all, understand how the term of the loan relates to paying off principle on the loan. Lets imagine two identical cars being sold for the same financing amount, lets say $9999, with a 7% interest rate. One customer gets a loan for 36 months (3 years) and their payment is $336 per month. The other customer gets a loan for 60 months (5 years) and their payment is $214 per month. Now imagine in 18 months after the sale, they both want to trade in their cars. The first customer with a higher monthly payment over a shorter term loan, will have more equity in their vehicle and will more likely avoid having negative equity on their trade. The second customer however has paid off less of the principle balance of their loan, because their loan was paying off the principle over a longer term.

So what if you're the second customer? You have a loan for a long term of 5, 6 or 7 years, and you don't imagine you want to keep driving this car forever, what can you do? If your budget allows you to pay an additional $20, $50, $100 or more per month with your car loan... do it! This will pay down the principle balance (the amount financed) of your loan. Not only will this reduce the total amount of interest you are paying during the loan (when your payments are on time), but will help you avoid negative equity in your loan. The more of your vehicle that you have paid off, the less you subsequently owe on your loan. When your vehicle is worth more than you owe, then you've avoided the negative equity dilemma.

So you may be wondering if there are any other ways that you can avoid having negative equity besides, shorter terms and paying off principle. There are a couple other things for you as a customer to consider. Try not to "bite off more than you can chew." If a finance director is trying to get you a loan so you can get a car and increase their sales, but the payment is still high over a long term loan, consider your options for a vehicle with a lower selling price. Always know your budget, and what you can afford before you start your loan documents. If you already have a lot of debt obligations with rent, child support, insurance, utilities, it is important to know exactly what is left for the car payment.

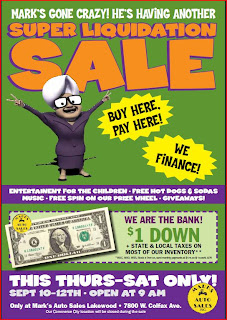

These are a couple considerations that I hope you will take into account if you ever consider trading in your vehicle that you may not have paid off. Mark's Auto Sales's buy here pay here program does assist our customers to "graduate" and trade in their vehicle for an "upgrade" when they have had on time payments for a minimum of 18-24 months depending on their vehicle and loan. Additional downpayment and a good payment history with a Mark's Auto Sales buy here pay here loan, has assisted customers get into a nicer newer vehicle and avoid having negative equity in their first loan. Please give us a call (303-592-7725) if you are a current or prospective customer and need any assistance with your next vehicle.

Thanks,

Staci @ marksautosales . com